- Suite B.19, Unique Shopping Mall, Urban & Physical Planning Way, (off Oba Akinjobi Way, by Muiz Banire Street), near Old Passport Office, GRA Ikeja.

- +234-8164841847

You are welcome as a member. Fulfill your duties as a Muslim to Allah, your family (ies), neigbhours and Society at large. And never forget to Pay your Dues and Zakat.

You are Welcome back. Fulfill your duties as a Muslim to Allah, your family (ies), neigbhours and Society at large. And never forget to Pay your Dues and Zakat.

You are welcome as a member. Fulfill your duties as a Muslim to Allah, your family (ies), neigbhours and Society at large. And never forget to Pay your Dues and Zakat.

You are Welcome back. Fulfill your duties as a Muslim to Allah, your family (ies), neigbhours and Society at large. And never forget to Pay your Dues and Zakat.

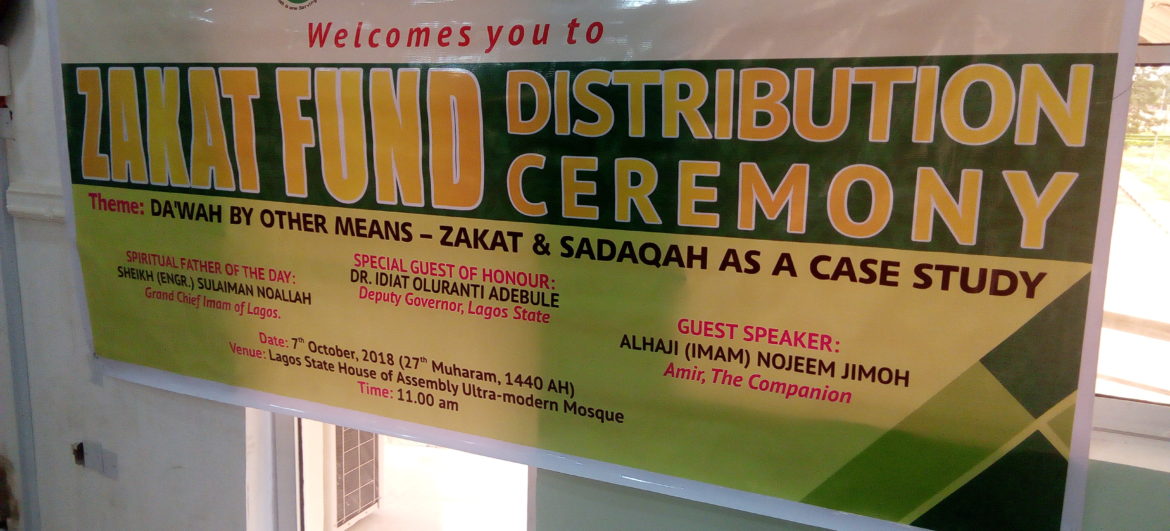

Zakat Distribution: Economic Empowerment for Muslims

- November 20, 2018

- By thesec??

- Charity, Empowerment, Zakat

Zakat Distribution: Economic Empowerment for Muslims

Zakat Collection and Distribution are one of the major programs of The Companion.

Zakat (alms) is one of the five pillars of Islam. Its importance can be realized from the fact that in 82 verses of the Qur’an, Zakat is associated with prayer (Salah), such as: “Establish regular prayer and give Zakat; and obey Allah and His Messenger.” (Qur’an, 33:33)

If social justice and compassion to fellow humans who are disadvantaged is one of the central themes in the message of Allah to humanity, then it is no wonder that Zakat, like prayer and fasting, was also enjoined upon the people of the past messengers: “And We made them (descendants of Abraham) leaders, guiding by Our command, and We sent them inspiration to do good deeds, to establish regular Prayers and to practise Zakat; and they constantly served Us.” (Qur’an, 21:73)

The wisdom of giving Zakat

It purifies your wealth as Allah Almighty says in the Qur’an: “Take alms from their wealth in order to purify them and sanctify them with it and pray for them.” (Qur’an, 9:103)

It reminds Muslims of the fact that whatever wealth they may possess is due to the blessings of Allah and as such it is to be spent according to the His commands.

Zakat functions as a social security for all. Those who have enough money today pay for what they have. If they need money tomorrow they will get what is necessary to help them live decently. Zakat payer pays his dues to Allah as an act of worship, a token of submission and an acknowledgment of gratitude. The receiver of Zakat receives it as a grant from Allah out of His bounty, a favor for which he is thankful to Allah.

Economically, Zakat is the best check against hoarding. Those who do not invest their wealth but prefer to save or hoard it would see their wealth dwindling year after year due to inflation etc. Zakat helps increase production and stimulates supply because it is a redistribution of income that enhances the demand by putting more real purchasing power in the hands of the poor.

It keeps one away from sin and saves the giver from the moral ill arising from the love and greed of wealth.

Through Zakat, the poor are cared for, these include widows, orphans, the disabled, the needy and the destitute.

Zakat is the right of the poor. Zakat is not considered a favor that is given to the poor by the rich. It is the right of the poor on the wealth of the rich. Allah says: “(In their) wealth there is a known share for the beggars and the destitute” (Qur’an, 70:24-25)

Zakat, therefore, is unlike charity that is given to the needy voluntarily. Withholding Zakat is considered depriving the poor of their due share. Thus one who pays Zakat actually “purifies” his wealth by separating from it the portion that belongs to the poor.

Virtues of Zakat

Allah says in the Qur’an: “The parable of those who spend their wealth in the way of Allah is that of a grain of corn. It grows seven ears and each ear has hundred grains. Allah increases manifold to whom He pleases.” (Qur’an, 2:261)

The beloved Messenger of Allah (peace be upon him) is reported to have said about Zakat:

• Zakat is a (great and strong) bridge of Islam.

• If a man pays the Zakat due on his property, it causes its evil influence to vanish.

• Gains the pleasure of Allah.

• Increases wealth and protects from losses.

• Causes Allah’s forgiveness and blessings.

• Protection from the wrath of Allah and from a bad death.

• A shelter on the Day of Judgment.

• Security from seventy misfortunes.

Alqamah (may Allah be pleased with him) says that when a group of people visited the Prophet (peace be upon him) he said to them, “Verily you can make your Islam perfect by your payment of the Zakat due on your property.”

The Prophet (peace be upon him) said, “He who observes three things will taste the sweetness of Iman (faith): One who worships Allah alone and believes (from his heart) that there is no one to be worshipped but Allah and one who pays the Zakat on his property, willingly, every year. In Zakat on the animals, one should not give an aged animal or one suffering from itch or any other ailment, or an inferior one, but should give animals of average quality. Allah Almighty does not demand from you the best of your animals, nor does He command you to give animals of the worst quality.”

Do I have to give Zakat?

Zakat is obligatory on an adult sane Muslim who has wealth that reaches or exceeds a certain level called the nisab for a lunar year. (You may contact your local scholars about the exact amount of nisab in your local currency). Unlike tax, however, Zakat is an act of worship for which one receives reward from Allah Almighty.

Ignoring to pay Zakat, on the other hand, is a major sin.

Zakat (alms) is one of the five pillars of Islam. Its importance can be realized from the fact that in 82 verses of the Qur’an, Zakat is associated with prayer (Salah), such as: “Establish regular prayer and give Zakat; and obey Allah and His Messenger.” (Qur’an, 33:33)

How much do I have to give?

If you are in possession of money, gold, silver, stock in trade or shares that amount to more than the value of nisab (at current market rates) then you are obliged to pay Zakat. What amounts are owed by you should be deducted from the capital amount before Zakat is calculated. The rate of Zakat is 2.5%.

The Prophet (peace be upon him said: “The upper hand is better than the lower hand (i.e. he who gives in charity is better than him who takes it).” (Bukhari)